Title loan lien release letters are essential documents in short-term lending, signaling a lender's abandonment of their claim on a borrower's vehicle, originally pledged as collateral. These legal documents empower borrowers to reclaim ownership, facilitate access to alternative financing, and enable them to use the asset for emergency funds or new financial opportunities. Key elements include loan details, outstanding balance, release terms, and signatures from authorized representatives. By requesting a title loan lien release letter upon full repayment, borrowers protect their rights and gain freedom over their assets.

In the complex landscape of financial transactions, understanding title loan lien release letters is crucial. These legal documents play a pivotal role in severing liens associated with title loans, enabling borrowers to reclaim ownership of their assets. This article serves as a comprehensive guide, offering insights into the significance and structure of such releases. We’ll break down the essential components, provide a detailed sample letter, and highlight best practices for securing a successful lien release process, focusing on optimal Title Loan Lien Release outcomes.

- Understanding Title Loan Lien Release Letters

- Components of a Valid Lien Release Letter

- Sample Lien Release Letter for a Title Loan

Understanding Title Loan Lien Release Letters

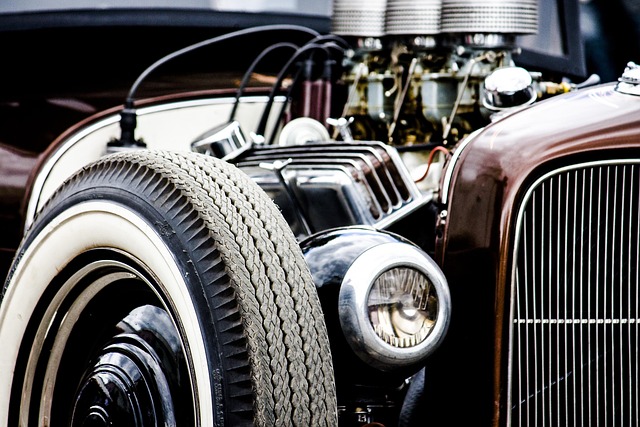

Title loan lien release letters are crucial documents in the world of short-term lending. They serve as official notifications that a lender is releasing their claim on a borrower’s vehicle, which had been put up as collateral for the loan. This process allows borrowers to regain full ownership and freedom over their asset, often enabling them to use it for emergency funds or explore new financial opportunities.

Understanding these letters is essential for borrowers who have exhausted their loan options or wish to extend their repayment period. A lien release letter typically includes detailed information about the original loan, the amount outstanding, and the terms of the release. It’s a legal document that ensures the borrower’s rights are protected, enabling them to seek alternative financing or even apply for another title loan with improved financial standing.

Components of a Valid Lien Release Letter

A valid Title Loan Lien Release letter is a crucial document that signifies the formal termination of a lien on a borrower’s asset, typically a vehicle, as per the terms of a loan agreement. This letter ensures that the borrower is no longer obligated to maintain the collateral (in this case, the vehicle) until the debt is fully repaid. Key components that constitute such a release include:

1. Clear Identification: The letter must clearly state the type of loan (e.g., Motorcycle Title Loans) and the specific lien being released. It should include unique identifiers like loan numbers or vehicle registration details to avoid any confusion or mix-ups with other loans or collateral.

2. Confirmation of Repayment or Default: It should confirm that the associated debt has been satisfied, either through full repayment or declaration of default. This is essential as it triggers the release of the lien and allows the borrower to regain full ownership rights over their vehicle without any legal encumbrances.

3. Date and Signatures: A valid lien release is dated and signed by an authorized representative of the lender, ensuring its authenticity and legal validity.

Sample Lien Release Letter for a Title Loan

When a borrower repays their title loan, they are entitled to request a lien release letter from the lender. This formal document confirms that the lender has no further claim over the borrower’s vehicle, and it’s a crucial step in regaining full Vehicle Ownership. A sample lien release letter for a Title Loan typically includes essential details such as the borrower’s name, loan number, vehicle description, and the date of repayment. It should be drafted by the lender or their authorized representative, stating that the loan has been fully settled and all associated liens are released.

For instance, in the case of Fort Worth Loans, a borrower who has utilized emergency funds to repay their title loan would receive a lien release letter specifying the loan amount, interest rates, and the final repayment date. This document serves as legal proof that the lender has fulfilled its obligations, and the borrower can now transfer Vehicle Ownership without any encumbrances. It’s a simple yet critical process ensuring borrowers’ rights and freedom regarding their assets.

A title loan lien release letter is a crucial document in ensuring clear ownership after repaying a title loan. By understanding the essential components and following the provided sample format, individuals can navigate the process efficiently. This article has outlined the key elements, offering a comprehensive guide to crafting valid lien release letters for title loans, thereby facilitating a smooth transfer of ownership rights.