To refinance a title loan, obtain a Title Loan Lien Release by providing updated documentation including ID, residency proof, vehicle records, and direct deposit preferences. Fill out lien release forms with accurate details and notify lenders. This process ensures ownership transfer, cancels liens, and provides access to funds without restrictions.

Thinking of refinancing your title loan? It’s crucial to understand the title loan lien release requirements involved. This guide breaks down everything you need to know, from gathering essential documents to understanding the steps for securing a lien release. By following these guidelines, you can confidently navigate the process and regain full control of your asset.

- Understanding Title Loan Lien Release Requirements

- Documents Needed for Refinancing Process

- Steps to Secure Lien Release for Your Title Loan

Understanding Title Loan Lien Release Requirements

When considering refinancing a title loan, understanding the lien release requirements is paramount. These requirements dictate how and when the lender will release their hold on your vehicle’s title. The process often involves providing updated documentation, such as proof of insurance and proof of income, to ensure you still meet the lender’s criteria for repayment. Additionally, understanding the terms of your original loan agreement is crucial in navigating the refinancing process smoothly.

One significant aspect of title loan lien releases is that they typically require a formal application through an online platform. This digital approach streamlines the process, making it more accessible and often faster than traditional methods. Moreover, many lenders offer flexible payment plans and don’t conduct a credit check, making refinancing an option for individuals with less-than-perfect credit histories.

Documents Needed for Refinancing Process

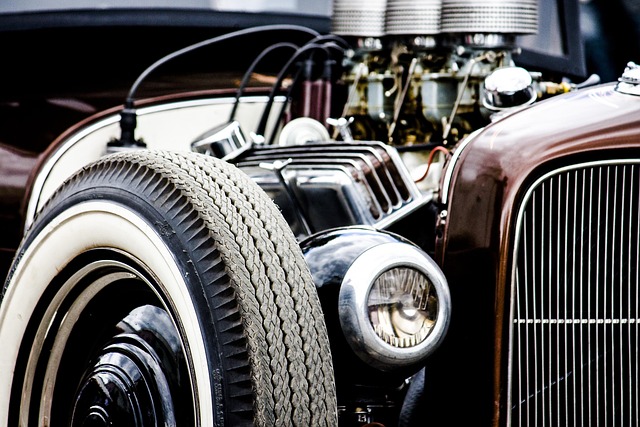

When considering refinancing a title loan, understanding the required documents is essential. The primary focus here is obtaining a title loan lien release, which allows for the transfer of ownership and cancels the existing lien on the asset, typically a vehicle like a car or truck (Truck Title Loans). This process requires several key documents to ensure a smooth transition.

Lenders will request proof of identity and residency, such as government-issued IDs and utility bills. Additionally, you’ll need to provide evidence of the current loan and its terms, including the original loan agreement and any modifications or extensions. For Car Title Loans, the vehicle’s registration and title records are crucial. Lastly, a clear understanding of the new loan terms and refinanced amount is vital to demonstrate how this financial solution aligns with your needs.

Steps to Secure Lien Release for Your Title Loan

Securing a lien release for your title loan is a crucial step in refinancing or selling your asset. The process involves several key actions to ensure a smooth transition. Firstly, gather all necessary documentation related to your original title loan agreement and the new refinancing terms. This includes proof of identification, current vehicle registration, and any evidence of insurance. Additionally, you’ll need to provide details about the direct deposit method preferred for your funds.

Next, contact both the original lender and the new financial institution involved in the refinance process. Inform them of your intention to release the lien and follow their respective procedures. Typically, this involves filling out a lien release form, which requires accurate vehicle information and the prior lender’s details. Once these steps are complete, the new lender will facilitate the direct deposit of funds into your account, ensuring you have immediate access to your emergency funding without any legal restrictions.

When considering refinancing your title loan, understanding and fulfilling the required title loan lien release conditions is paramount. By gathering the necessary documents and adhering to the outlined steps, you can successfully secure the release of liens on your vehicle, allowing for a smoother transition to a new loan agreement. Remember, each state has its own regulations regarding title loans, so always refer to local laws when navigating this process.