When repaying a title loan, borrowers can reclaim their vehicle through a title loan lien release process after fulfilling all repayment obligations. This is crucial for individuals relying on their vehicles for emergencies or livelihoods. The lender initiates the release upon receipt of full payment and required documents like insurance proof and the original title certificate. Timely repayments ensure a swift process. Gathering correct paperwork, including proof of repayment and accurate vehicle details, is essential; consulting a professional is advised for complex cases.

After fully repaying your title loan, you may wonder how to remove the lien on your vehicle’s title. This process, known as a title loan lien release, is crucial for reclaiming full ownership of your asset. This article guides you through understanding the lien and navigating the release process, highlighting key steps and legal considerations. We’ll explore the required documents, ensuring you’re prepared to officially end the lien and regain control of your vehicle’s title.

- Understanding the Title Loan Lien

- The Process of Lien Release After Repayment

- Legal Considerations and Required Documents

Understanding the Title Loan Lien

When you take out a title loan, it’s secured by your vehicle’s title, meaning if you fail to repay the loan, the lender can initiate a title loan lien release process to reclaim and sell your vehicle. This serves as a legal protection for the lender, ensuring they recover their investment. Understanding this aspect is crucial when borrowing against your vehicle, especially considering the potential financial implications if repayment cannot be met.

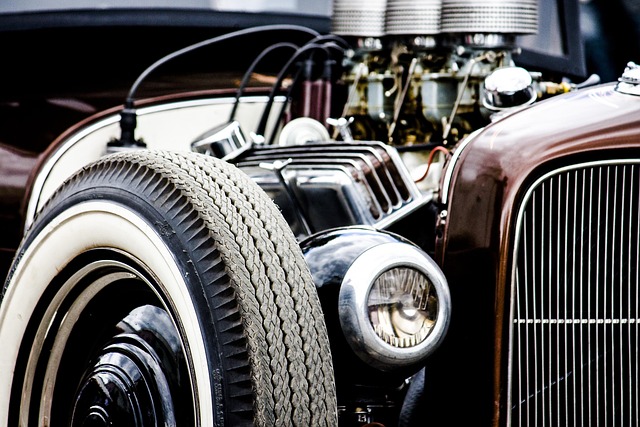

A title loan lien release allows you to regain full ownership of your vehicle once the outstanding balance is fully repaid. After fulfilling your repayment obligations, you can contact the lender to initiate the process, which typically involves submitting necessary paperwork and verifying the absence of any remaining debts associated with the loan. This is a vital step, especially for those relying on their vehicles as emergency funds or for livelihoods like semi-truck drivers who depend on their rigs for work.

The Process of Lien Release After Repayment

After full repayment of a title loan, the process to release the lien on your vehicle is straightforward but crucial. The lender will typically initiate this procedure upon receipt of all outstanding payments, including interest and fees. They will request essential documents from you, such as proof of insurance, a valid driver’s license, and the original title certificate. Once these are verified, the lien release process can be finalized with the appropriate government agency responsible for vehicle registration.

This ensures that your vehicle is officially freed from collateral status, allowing you to transfer ownership or sell it without restrictions. It’s important to note that keeping up with repayment terms is key to retaining control over your vehicle throughout the title loan period and facilitating a swift lien release post-repayment. Additionally, understanding local regulations regarding Dallas title loans can streamline this process, enabling you to keep your vehicle as desired after full repayment.

Legal Considerations and Required Documents

After fully repaying your title loan, the next step is to understand the legal considerations and documents required for a lien release. This process varies slightly depending on your location but generally involves several key steps. First, ensure all loan requirements have been met, including making the final payment in full, as per the agreed-upon terms. Once the loan is considered satisfied, you can initiate the process of obtaining a lien release.

The specific documents needed for a title loan lien release may include proof of repayment, often in the form of a cancelled check or bank statement, along with any applicable fees. It’s also crucial to have accurate and up-to-date information about the vehicle’s registration and ownership details. Given the legal nature of these transactions, it’s advisable to gather all necessary paperwork meticulously and consult with a professional if needed, especially when dealing with complex loan requirements, interest rates, or flexible payment plans.

After fully repaying a title loan, the next step is to ensure the lien on your vehicle is released. Understanding the process involves navigating legal considerations and providing the necessary documents. By adhering to these procedures, individuals can regain full ownership of their vehicles without any legal encumbrances. This seamless transition not only provides peace of mind but also opens doors for future financial opportunities.