Title loan lien release is a complex process crucial for restoring asset ownership rights. Lenders demand accurate documentation and stringent procedures, including proof of repayment and final agreements. Strategic communication, understanding loan terms, and meticulous record-keeping are key to expediting releases, providing financial relief, and securing control over assets.

In today’s financial landscape, understanding title loan liens and their impact is crucial. These secured loans, often used by individuals with limited access to traditional credit, can create significant challenges when it comes to releasing liens. This article delves into the complexities of obtaining lien releases from closed title loan lenders, exploring common obstacles and strategic solutions. By examining these factors, borrowers can navigate the process more effectively, ultimately achieving freedom from these financial burdens.

- Understanding Title Loan Liens and Their Impact

- Challenges in Obtaining Lien Release from Lenders

- Strategies for Successfully Releasing Title Loans Liens

Understanding Title Loan Liens and Their Impact

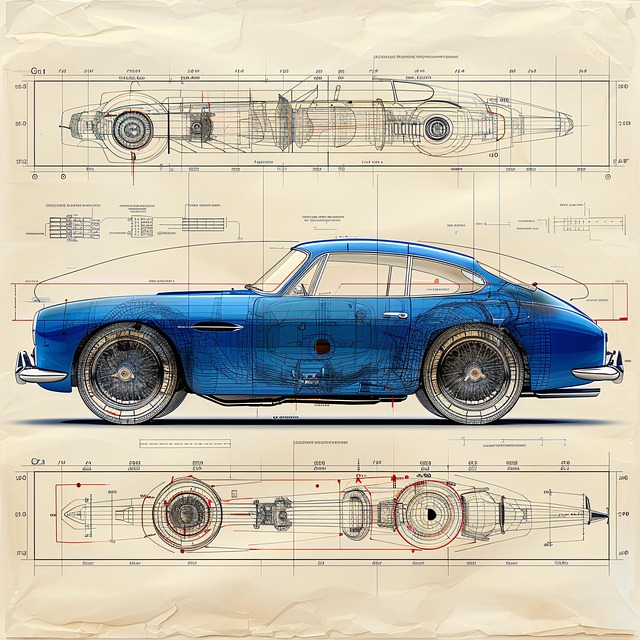

Title loan liens can significantly impact an individual’s financial standing and asset ownership rights. These liens are legal claims against a borrower’s vehicle, typically imposed when they take out a short-term loan secured by their car title. The lender retains a security interest in the vehicle until the loan is fully repaid, which means they have the right to repossess the vehicle if the borrower defaults on payments. This can result in severe consequences for borrowers, especially those reliant on their vehicles for daily transportation or livelihood.

Understanding how these liens work and the challenges associated with their release is crucial. The process of loan payoff involves settling the outstanding debt, which, in some cases, may allow the borrower to regain full ownership rights. However, the lender must also consider factors like vehicle valuation and loan requirements to ensure a fair resolution. Efficient lien release can help borrowers move forward, but it requires careful navigation through complex financial regulations and terms set by closed title loan lenders.

Challenges in Obtaining Lien Release from Lenders

Obtaining a lien release from closed title loan lenders can present several challenges for borrowers. One of the primary difficulties lies in the communication and coordination required to facilitate this process. Lenders often have stringent procedures for releasing liens, which can be complex and time-consuming. Borrowers must gather various documents, including proof of repayment, final settlement agreements, and any relevant records related to the loan, to initiate the lien release request.

Moreover, the title loan process involves multiple stakeholders, each with their own set of requirements and deadlines. Lenders may require borrowers to complete an online application for the lien release, which offers the convenience of same-day funding. However, this also means borrowers must navigate a digital process, ensuring all information is accurate and up-to-date. Delays or errors in these applications can lead to further complications, making it crucial for borrowers to approach the procedure with careful consideration and thorough documentation.

Strategies for Successfully Releasing Title Loans Liens

Releasing a title loan lien can be a complex process, but with the right strategies, it can be successfully navigated. One effective approach is to initiate open communication with the closed title loan lender. Many lenders are more than willing to facilitate a lien release if they receive a formal request accompanied by the necessary documentation. This may include proof of repayment in full or an agreed-upon settlement amount.

Additionally, understanding the specific terms and conditions outlined in the original loan agreement is crucial. Some contracts may include clauses that detail the process for lien removal, while others might require additional steps such as a title transfer or updated registration details to officially sever the lien. Ensuring you have all the required paperwork ready and adhering to the lender’s guidelines can significantly expedite the lien release process, offering much-needed financial assistance and allowing for greater autonomy over your assets.

Navigating the complexities of title loan liens can be challenging, especially when seeking a release. However, by understanding these challenges and employing effective strategies, individuals can successfully free themselves from these financial constraints. Remember that timely communication, thorough documentation, and persistent effort are key to securing a lien release from closed title loan lenders. In summary, staying informed about your rights and taking proactive steps can help resolve title loan liens, enabling you to move forward with financial freedom in mind.